Increase In Tax Exemptions The Most Common Demand From Union Budget 2015

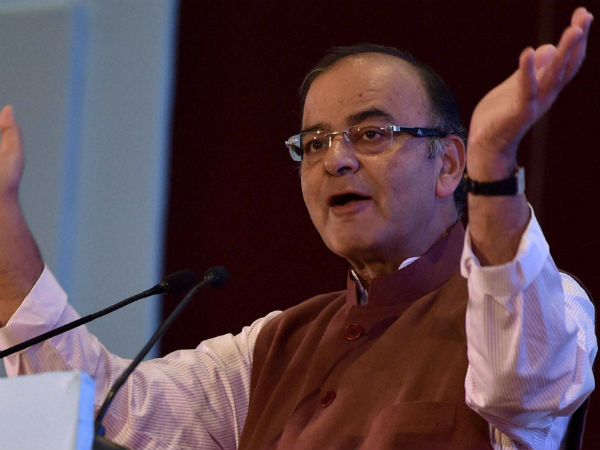

Arun Jaitley is all set to unveil the Union Budget 2015-16 on Feb 28. Industry and industry bodies have made a whole lot of demands from the Union Budget.

Though individuals hardly make a presentation to the Finance Minister, it's time they got some decent tax breaks.

This maybe the right time to do so, as subsidy costs have declined substantially and the current account deficit is well under control, providing the government with more flexibility to raise tax limits and allowances.

"Last year we saw the Sec 80C limit being hiked to Rs 1.5 lakhs. I would suggest that it be further increase given that household savings have fallen sharply since 2008.

It would also encourage savings in financial instruments and not assets like gold," says Neville Andrew a Chartered Accountant.

Many things have remained stagnant as part of allowances and these need to be hiked. "Tax exemption in Travel Allowance has remained at Rs 800 for the last so many years, while the cost of travel has gone up dramatically, the Finance Minister should consider the same," he says.

Some allowances are so outdated that they need to be reviewed by the government, considering the cost of inflation.

Education allowance is currently exempt only up to Rs 100 per month per child for a maximum of two children. Now, this sum of Rs 100 per month is highly unrealistic and the government needs to review the same.

It's also high time the government considers an increase in tax bracket limits. Last year Finance Minister Arun Jaitley hiked the basic tax limit to Rs 2.5 lakhs.

"To hike the tax limit would mean greater savings in the hands of individuals which could push demand for good and products and thus propel growth," says Amit G, an employee of a foreign airline.

Also many of the allowances have not been touched for many years now. For example tax exemption on meal vouchers is only Rs 50 per meal.

This must be enhanced, as it may be difficult to get meals, especially in the city in such a small amount. This has not been reviewed for many years now.

Apart from this consider another allowance which is not in tune with reality. Hostel allowance, is exempt for hostel expenditure up to Rs. 300 per month per child for a maximum of two children.

It's very low sum considering such high hostel expenditure these days and is not in sync with times.

All of these allowances need to be re-looked into at the very earliest.

Conclusion

Clearly, what the common man wants from the Union Budget 2015-16 is a relook at the tax benefits, allowances and a hike in the tax exemption limit.

Though inflation has fallen over the last few years, the cost of living in terms of a making a home, education and medical costs continue to remain very high. The Finance Minister must provide reprieve to the common man.

GoodReturns.in