What is the LIC Maturity Claim Procedure?

In today’s world of consumerism, the requirement of insurance has expanded to keep the pace with the increasing risks. Today we have a wide variety of insurance schemes for covering risk ranging from

In today's world of consumerism, the requirement of insurance has expanded to keep the pace with the increasing risks. Today we have a wide variety of insurance schemes for covering risk ranging from health insurance to vehicle insurance to theft insurance to even wedding insurance. The question which arises here is once we have the required insurance coverage and has paid the premium amount as per the set period, how to claim the maturity amount of the insurance policy post-maturity in Life Insurance Corporation of India (LIC).

What is Life Insurance?

Life Insurance is a contract that pledges payment of an amount to the person assured (or nominee) on the happening of the event insured against.

The contract is valid for payment of the insured amount during:

• Date of Maturity

• Specified dates at periodic intervals

• Unfortunate Death, if it occurs earlier.

Life Insurance Corporation of India

Life Insurance Corporation of India is one of the prominent insurance providers in the country. Its presence can be found across the country. Being one of the oldest insurance providers in the country, it provides various benefits to the people who invest in its insurance schemes. Life Insurance Corporation of India is popularly known as LIC.

What is Maturity Date?

It is a date on which the principal amount of a note or draft or acceptance bond or another type of debt instrument becomes due and is repaid to the investor and the interest payments stop. It defines the lifespan of security, informing the customer as to when he/she will get the principal back and for how long one will receive the interest payments.

When a life insurance policy is about to mature, the service branch of LIC of India will send an advance maturity claim intimation letter to the policyholder usually before two months.

Documents Required for Maturity Claim Discharge

1. Original LIC Policy Document

2. Identity Proof

3. Age Proof (if not submitted previously)

4. Cancelled Cheque leaf or a copy of the Policy holder's Bank Passbook

5. NEFT Mandate Form (to transfer the maturity proceeds directly to the policyholder's account)

6. Assignment/ Reassignment (if any)

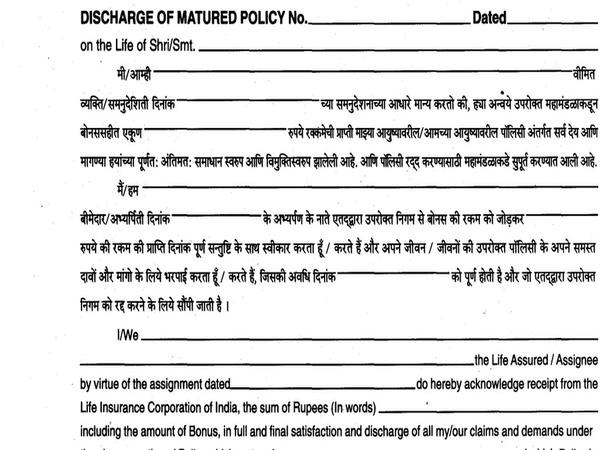

Discharged Receipt Form No 3825

The policyholder has to submit the discharged receipt in Form No. 3825 and other required documents along with the original policy documents at least one month before the due date so that the payment is received before the due date of maturity claim.

The settlement procedure for maturity claim is simple after receipt of completed and stamped discharge form. The policy's maturity claim amount will be paid directly to the policy holder's account.

Maturity Claim Amount

If the policyholder does not receive any intimation for the claim due within the next two months, then they have to contact the servicing branch along with the documents mentioned above.

It is better to submit all the documents to the servicing branch personally rather than sending the documents by post/courier, as there is a risk that one might lose the original LIC Policy Document in post/courier transit.

The Life Insurance Corporation of India has provided an exclusive online platform for its customers as an initiative to help the customers to claim the maturity amount.

Tax Benefits on Maturity of Insurance Policy

The policy holder is eligible to get exemption on any amount received at the time of maturity of the insurance policy under Section 10(10D) of the Income Tax Act of 1961.

But the amount received under the following life insurance policies are not eligible for exemption under the Income Tax Act:

a) Amount received under a Keyman Insurance Policy.

b) Amount received from the LIC policy which is issued on or after April 1, 2013 but on or before March 31, 2012 in respect of which the premium is payable for any of the year during the term of the policy exceeds 20% of the actual sum assured.

c) Amount received from an LIC policy which is issued on or after April 1, 2012 in respect of which premium payable for any of the years during the term of the policy exceeds 10% of the actual sum assured (15% in case if the policy is for insuring the life of the disabled dependent).

Death of Policy Holder

In case of Death of the Policy Holder, his/her appointed nominee can get the policy amount by submitting the required documents. The individual who is legally entitled to receive the policy money (nominee) should intimate about the death of the policy holder to the servicing branch.

The following are the list of documents which has to be submitted to get the policy amount:

- Claim Form ‘A' in Form No. 3783, if the policy has run for 3 years or more from the date or risk, or else Claim Form No. 3783A may be used.

- The original policy document with deed of assignment/s (if any)

- Certified extract from death register issued by the respective officials (hospitals, Doctors, district level authorities)

GoodReturns.in

About the Author

Archana is a Content Writer at GoodReturns. She has been writing articles related to investment planning and personal finance for more than two years.