Immediate Payment Service (IMPS) is a remittance service through which one can transfer money anytime, anywhere across India.

Registered IMPS customers can transfer money instantly to any person or to a merchant, for any personal or commercial purpose.

The main benefit of of IMPS is that it is available round-the-clock and operates even during bank holiday, weekends or festive holidays.

IMPS can be used in three platforms such as Mobile, Internet and ATM across any bank in India. One can also send funds by using Aadhaar number of the recipient. However, Aadhaar Card number should be linked to the account.

Once can follow four simple steps as mentioned below:

1) Register your mobile number

2) Details of the beneficiary like their account number, IFSC code and all other relevant details.

3) How to transfer (select a convenient channel to transfer money like mobile, internet banking etc. )

4) Enter recipient details

How to Send Funds

- Login to your bank account

- Select the IMPS or fund transfer or use the SMS facility in your mobile if your bank provides IMPS on SMS

- Get Beneficiary Mobile number and MMID

- Enter Beneficiary Mobile number, beneficiary MMID, Amount and your MPIN to send

- You will receive SMS for the debit in your account and credit in beneficiary account

- Note the transaction reference number for any future query

What is IMPS?

IMPS basically involves a transfer mechanism using the mobile phone. A host of banks allow the transfer through this mechanism including the reputed banks like State Bank of India, ICICI Bank and Axis Bank.

There are some restrictions depending on the banks. For example, State Bank of India permit only one beneficiary in a calendar day. Which means one cannot send money through IMPS for more then one beneficiary in a day.

These services are available from 8 am to 8 pm during normal banking days. In case the money is not remitted for whatever reason the same would be credited back to the remitters account.

India's largest lender State Bank of India charges a rate of Rs 5 for the remittance. You cannot initiate the transfer of funds without money in your account like in the case of all other applicable internet banking accounts.

Whenever the personal remitting does so, he will receive a message from the bank stating that he has initiated the transaction. On the other hand when the amount is received by the beneficiary there will also be a similar message.

GoodReturns.in

More From GoodReturns

Gold Rates & Silver Rates Today Live: Spot Gold Price Jumps 2% As Crude Oil Prices Fall; 24K, 22K, 18K Gold

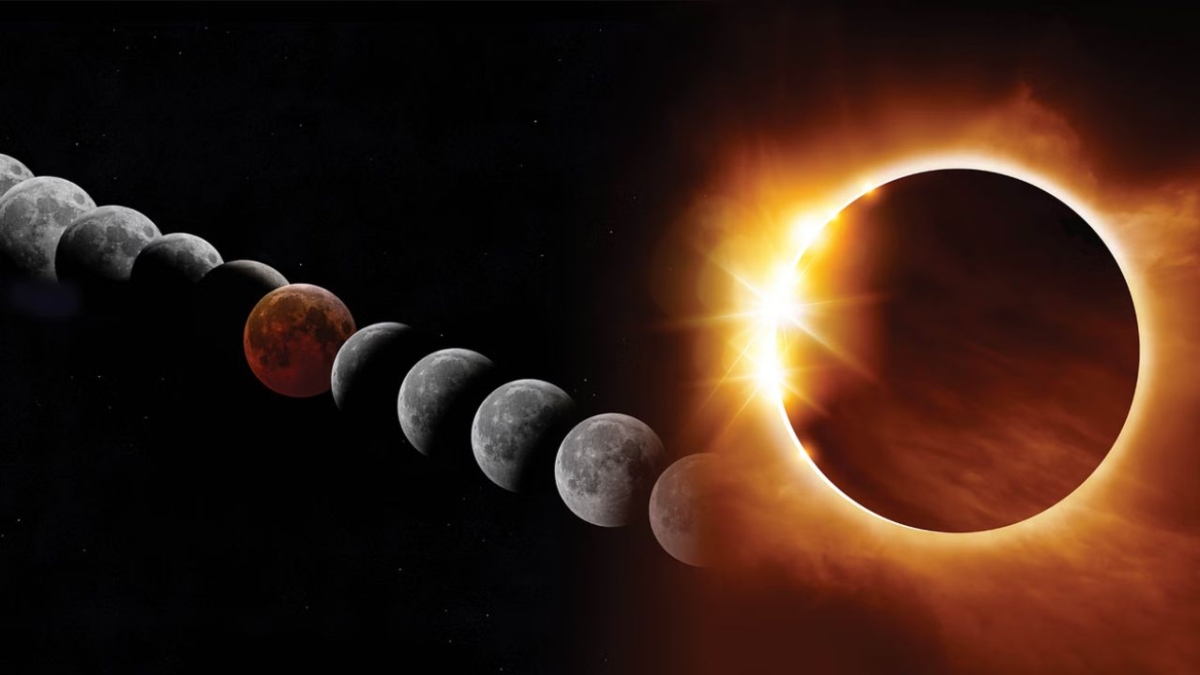

Lunar Eclipse Today: Chandra Grahan Timings, Sutak Kaal, Do's & Don'ts For Pregnant Women During Blood Moon

Happy Holi 2026: Best 70+ Wishes, Greetings, Messages, Status To Share On March 3

Benjamin Netanyahu Dead? Is Israel's Prime Minister Bibi Alive? Check Iran's Claim & Fake News

Gold Rate in India Slips Around Rs 26,000/24K in Single Day Amid Escalating Iran-Israel, US Tension; Outlook

Gold Rates & Silver Rates Today Live: MCX Gold Ends Near Rs 1.67 Lakh, Silver Erases Gains; 24K, 22K, 18K Gold

Gold Rates In India Today Crash By Rs 31,100, Third Fall This Week; 24K, 22K, 18K Gold Prices On March 4

Gold Rates & Silver Rates Today Live: MCX Gold & Silver Price To Open Volatile After Holi; 24K, 22K, 18K Gold

Gold Rate Today: Gold Prices Crash Over Rs 1 Lakh per 24K/100g in 4 Days Amid Iran-Israel Conflict; Outlook

Fall in Gold Rate in India Continues; 24K/100gm Plunges Rs 85,800 in Just 3 Days; MCX Gold Price Flat; Outlook

Gold Rates In India Today March 6, 2026: Gold Rate Crash Fifth Day In Row By Rs 1,09,800; 24K, 22K, 18K Gold

Click it and Unblock the Notifications

Click it and Unblock the Notifications