IMPS is a real-time payment service that empowers customers to transfer money instantly through banks and RBI authorized Prepaid Payment Instrument Issuers (PPI) across India.

IMPS is an immediate payment service, used for fund transfer, which was launched by the National Payment Corporation (NPCI).

What is IMPS?

IMPS is a real-time payment service that empowers customers to transfer money instantly through banks and RBI authorized Prepaid Payment Instrument Issuers (PPI) across India.

How to use IMPS?

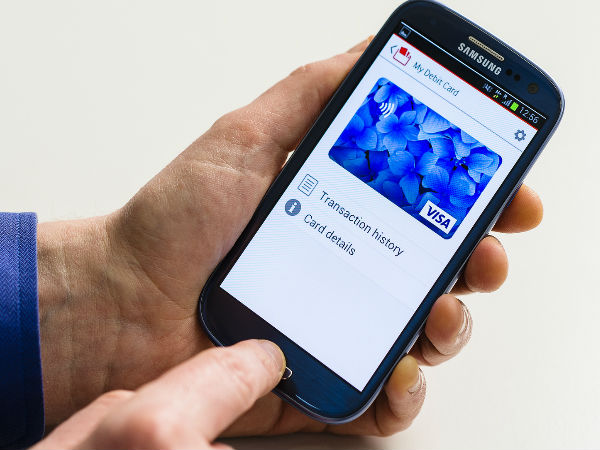

IMPS service is available 24X7 and can be used through mobile as well as internet banking. Individuals with net banking, need not register separately for availing IMPS option. Once you have logged on to the net banking window, you can see IMPS transfer option there.

Details needed for using IMPS

For using IMPS through internet banking, you need the following,

- Beneficiary's account number

- IFSC code of the bank branch

- In the case of mobile transfer, you have to know the beneficiary's account number as well as the MMID (Mobile Money Identifier) code.

- If you are opting for IMPS through mobile, there is no need to register the beneficiary.

Charges

The charges for using IMPS option are decided by banks. Generally, the charge is Rs 5 for transfer up to Rs 1 lakh and Rs 15 for Rs 1-2 lakh. A service tax is also levied. The charges may vary according to banks.

What are the services available under IMPS?

What are the services available under IMPS?

1. Funds Transfer and Remittances

- Sending Money

- Receiving Money

2. Merchant Payments

Merchant Payments

- Online shopping

- School & college fees payments

- Mobile top ups & DTH recharge

- Grocery bills

- Travel bill payments

- Credit card bill payments

- Utility bills payments

3. National Unified USSD Platform (NUUP)

National Unified USSD Platform is a USSD based mobile banking service from NPCI that brings together all the Banks and Telecom Service Providers. In NUUP, a customer can access banking services by just pressing *99# from his/her mobile phones.

4. Query Service on Aadhaar Mapper (QSAM)

QSAM (Query Service on Aadhaar Mapper) service helps the user in knowing their Aadhaar seeding status with their bank account. By dialing *99*99# this service can be availed. What Is RTGS? Know The Details

Goodreturns.in

More From GoodReturns

Gold Rate in India Slips Around Rs 26,000/24K in Single Day Amid Escalating Iran-Israel, US Tension; Outlook

Gold Rates In India Today Crash By Rs 31,100, Third Fall This Week; 24K, 22K, 18K Gold Prices On March 4

Gold Rates & Silver Rates Today Live: MCX Gold & Silver Price To Open Volatile After Holi; 24K, 22K, 18K Gold

Gold Rate in India Takes U-Turn! 24K Jumps Rs 23,000 In Day! Silver Stable After Weak US Jobs Data | March 7

Gold Rate Today: Gold Prices Crash Over Rs 1 Lakh per 24K/100g in 4 Days Amid Iran-Israel Conflict; Outlook

Fall in Gold Rate in India Continues; 24K/100gm Plunges Rs 85,800 in Just 3 Days; MCX Gold Price Flat; Outlook

Gold Rates In India Today March 6, 2026: Gold Rate Crash Fifth Day In Row By Rs 1,09,800; 24K, 22K, 18K Gold

Gold Rates & Silver Rates Today Live: Physical Gold Rates Jump, MCX Gold & Silver Outlook; 24K, 22K, 18K Gold

Happy Women's Day 2026: Top 50+ Wishes, Messages, Quotes, Captions, Greetings, Status To Share On March 8

Emirates, Etihad Flights Services Resume Partially; UAE Restores Limited Operations Amid Iran-Israel Conflict

LPG Prices In India From March 7: 14.2KG LPG Prices Hiked First Time In 1-Year By Rs 60; 19K LPG Up By Rs 115

Click it and Unblock the Notifications

Click it and Unblock the Notifications