With little over a week left for Finance minister Arun Jaitley to present the Annual Union Budget, let us take a look at the most significant budgets every presented in independent India that changed

This year will be the first budget presentation after GST (Goods and Services Tax), an important reform in India's taxation that was based on "one country, one tax" mission. Just like GST, there were many historic moments in India's budgeting that left an impact.

With little over a week left for Finance minister Arun Jaitley to present the Annual Union Budget, let us take a look at the five most significant budgets presented in independent India that changed our economy.

1. Feb 28, 1950

Finance Minister: John Matai

It was the first budget of the Republic of India. This was the year the decision to form a Planning Commission for India was made (which was later formed in March 1950). This commission was the institution that formulated India's five-year plans.

In 2014, PM Modi replaced the commission with NITI Aayog.

2. Feb 29, 1968

Finance Minister: Morarji Desai

Morarji Desai is the only Union Minister to have presented 10 budgets. In this particular year, he removed the compulsion of Excise Department officials to check all goods that left the factory gate. A system of self-assessment of goods by all small and big manufacturers was introduced. This helped boost manufacturing and reduced complications in administration in the removal of goods.

In the same year "spousal allowance" was withdrawn. In his budget speech, Morarji Desai said: "It would be improper for any outsider to decide as to who is dependent on whom... to eliminate this unintended strain on the relationship of marriage."

3. Feb 28, 1986

Finance Minister: Vishwanath Pratap Singh

The budget gave a beginning to a major indirect tax reform that led to the shift to GST as we now know it. V.P Singh proposed a major overhaul of the excise taxation structure in the budget of 1986-87.

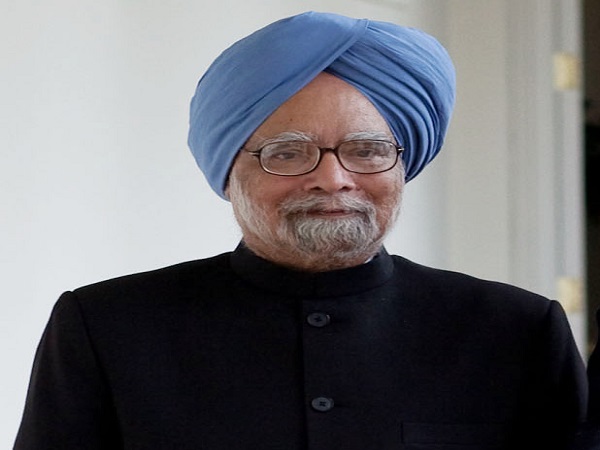

4. July 24,1991

Finance Minister: Dr. Manmohan Singh

As an expert economist, he proposed a change in the import-export policy to curb that year's balance of payments. There was a slash in import licensing and a vigorous export promotion. It was India's gateway to competition abroad.

India today, is one among the top ten economies of the world.

February 28, 1997

Finance Minister: P. Chidambaram

1997's budget brought a moderation of taxes rates for individuals and businesses. It amplified the tax base of the country. People who were hiding their income to evade taxes started to pay. The tax collections were gone up from Rs 18,700 crore in 1997-98 to Rs 1,00,100 crore by 2010-11.

More From GoodReturns

Fall in Gold Rate in India Continues; 24K/100gm Plunges Rs 85,800 in Just 3 Days; MCX Gold Price Flat; Outlook

Gold Rate Today: Gold Prices Crash Over Rs 1 Lakh per 24K/100g in 4 Days Amid Iran-Israel Conflict; Outlook

Gold Rate in India Takes U-Turn! 24K Jumps Rs 23,000 In Day! Silver Stable After Weak US Jobs Data | March 7

4:1 Bonus + 2:1 Stock Split + Rs. 12 Dividend: 3 Stocks to Watch as They Turn Ex-Date On March 9

Gold Rates In India Today March 6, 2026: Gold Rate Crash Fifth Day In Row By Rs 1,09,800; 24K, 22K, 18K Gold

Gold Rates & Silver Rates Today Live: MCX Gold & Silver May Take Hit On Inflationary Fear; 24K, 22K, 18K Gold

Gold Rate Today, 9 March Outlook: Rise in Gold Prices in India After Falling Nearly Rs 1.2 Lakh Per 24K/100gm

Gold Rates & Silver Rates Today Live: Physical Gold Rates Jump, MCX Gold & Silver Outlook; 24K, 22K, 18K Gold

LPG Prices In India From March 7: 14.2KG LPG Prices Hiked First Time In 1-Year By Rs 60; 19K LPG Up By Rs 115

Arjun Tendulkar-Saaniya Chandhok Wedding: Who is Sachin Tendulkar’s Daughter-in-Law? See Her Family, Net Worth

Stock Market Outlook, March 5: Sensex, Nifty May Stay Under Pressure Amid West Asia Tension, Rising Oil Prices

Click it and Unblock the Notifications

Click it and Unblock the Notifications