How To Deposit Money In Your Post Office RD Account Online?

A recurring deposit (RD) account at a post office is known to be one of the basic saving financial instruments among Indians for decades. It is an ideal step for those looking to start saving small amounts and cultivate the habit to set aside a fixed amount every month to build corpus.

However, over the years, the way in which one can save has changed drastically, even at the post offices. From having India Post agents collect your monthly installments in cash to making deposits using your phone, post office RDs and fintech has come a long way.

Features of Post Office RD

- A RD account at India Post can only opened by cash / cheque at the nearest post office. In case of cheque the date of deposit shall be date of presentation of cheque.

- This account can be transferred from one post office to another.

- The tenure of a post office RD is five years.

- The minimum monthly deposit that can be made is Rs 10. An amount higher than Rs 10 can be made in multiples of Rs 5.

- Any number of accounts can be opened in any post office.

- Account can be opened in the name of minor and a minor aged 10 years and above can even open and operate the account.

- Subsequent deposits can be made up to fifteenth day of next month if account is opened up to fifteenth of a calendar month and up to last working day of next month if account is opened between sixteenth day and last working day of a calendar month.

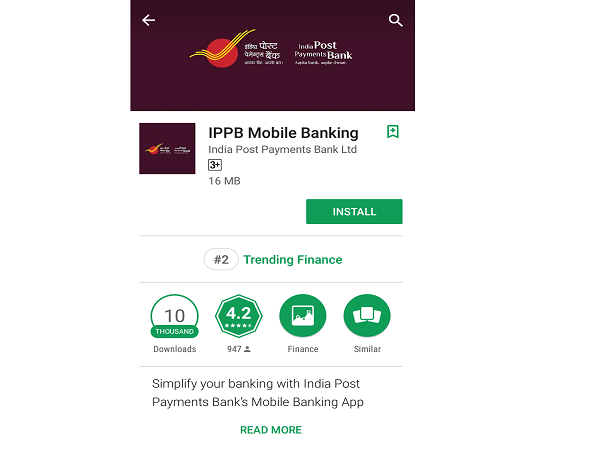

- Download the IPPB app, known as "IPPB Mobile Banking" app on Google Play (refer image).

- Open a digital IPPB account by signing up on the ‘Open your account now!' option.

- Enter basic information like PAN, mobile number and Aadhaar number to activate the account.

- An OTP will be sent to your mobile number for verification.

- Create an MPIN to complete setting up the account.

- Add the required amount from your bank account to the IPPB account.

- Go to "DOP Products," and choose "Recurring Deposit."

- State the RD account number and customer ID.

- Choose the installment duration and amount.

- IPPB will send a notification for successful payment transfer made through IPPB mobile app.

Before you deposit money to your post office RD

Online deposits to a post office RD can be made via the India Post Payments Bank (IPPB) app. You are required to visit the post office just once, that is, to open the RD account. You can manage the account via the app with the steps explained in this article, thereafter.

The Recurring Deposit account with Post Office must be in an active state to be able to access it over the IPPB app. You can do so with the RD account number and customer ID.

Withdrawal claims or closure of the RD also requires the account holder to visit the post office and cannot be processed over the app.