How To File Your Complaints Against Banks, NBFCs With RBI Online?

With a view to improve customer experience in the banking sector, the Reserve Bank of India (RBI) launched an application on its website to lodge complaints against banks and NBFCs (non-banking financial companies).

The Complaint Management System (CMS) software application was introduced to facilitate RBI's grievance redressal process.

Customers can now raise their issues against any regulated entity with public interface such as commercial banks, urban cooperative banks, Non-Banking Financial Companies (NBFCs).

Where to access the CMS?

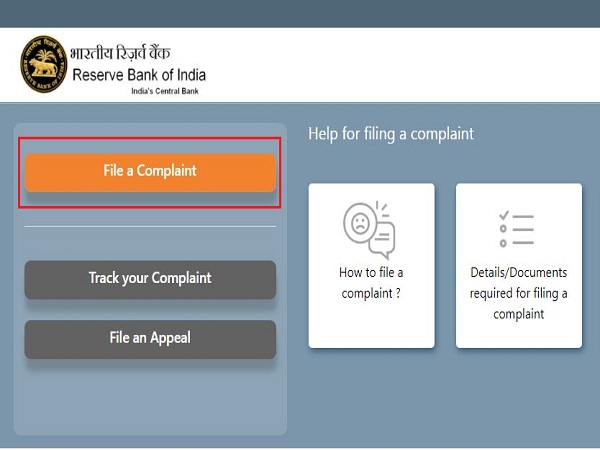

The CMS is accessible on desktop as well as mobile devices. Visit cms.rbi.org.in and click on the "File a Complaint" option to get started (refer image).

In the next step, you can select the language and the type of entity (refer image).

In the next window, you have to provide your details and details of the bank or NBFC. You also have an option to upload any files supporting the complaint made.

Tracking your compliant

Complaints filed using this software will be directed to the appropriate office of the Ombudsman/Regional Office of the RBI.

Once you file the complaint, you will be sent auto-generated acknowledgements. This will also enable you to track the status of their complaints and file appeals online against the decisions of the Ombudsmen, if you are not satisfied with the action taken.

The RBI also plans on introducing a dedicated Interactive Voice Response (IVR) system for tracking the status of complaints.

Improving transparency

The RBI has introduced the new system to make customers of banking services more alert and aware and safeguard them against the risks of mis-selling, cheating, frauds and other such threats.

The Central Bank also expects banks/FSPs to use the data collected on CMS for reducing their turn around time in resolution of complaints and strengthening their grievance redressal mechanism. The data would also be used for undertaking root cause analyses with an objective of understanding their customer pain areas, behaviour and expectations so as to improve their services for maintaining customer loyalty.

The data is also expected to help banks/FSPs for designing products which meet the expectations of their customers and have a competitive advantage.

Data from CMS can be leveraged by the central bank for analytics which can be used for regulatory and supervisory interventions, if required. Various dashboards provided in the application will help RBI to effectively track the progress in redressal of complaints.

With the launch of CMS, the processing of complaints received in the offices of Ombudsman and Consumer Education and Protection Cells of RBI has been digitalised.