You may not have received your tax refund despite filing your Income Tax Returns (ITR) on time or you may have other concerns that you wish to bring to the tax department's attention. The Central Board of Direct Taxes (CBDT) has an online e-form mechanism to address your tax-related issues.

Unlike the popular method of posting your concerns over Twitter and tagging the Income Tax Department, this method is confidential and is also the official mode to raise concerns.

How and where to file the online complaint form?

- You can directly visit this link or go to the e-filing portal www.incometaxindiaefiling.gov.in and click on "e-Nivaran" on the top right-hand side of the page.

- Click on "Submit Grievance."

- Enter your PAN or TAN.

- Login into the account on the portal.

- In the e-form that opens in the following pages, you can submit the name and PAN details of the taxpayer the grievance is related to.

- You will also need to provide details related to the assessment year, mobile number, email-ID and provide a brief description of your concern.

- A grievance reference number will be generated on submission of the complaint. Make note of the number to check the status of the complaint filed.

To check the status of the grievance, click on the "e-Nivaran" option again and enter the grievance reference number.

The turn-around time of the complaint filed wasn't specified by the Income Tax Department.

Helpline

The Income Tax Department also has helpline numbers that you can call. Click on the "Contact Us" option on the top right corner on the e-filing portal's main page or click here for details on the helpline numbers.

More From GoodReturns

Gold Rates & Silver Rates Today Live: Spot Gold Price Jumps 2% As Crude Oil Prices Fall; 24K, 22K, 18K Gold

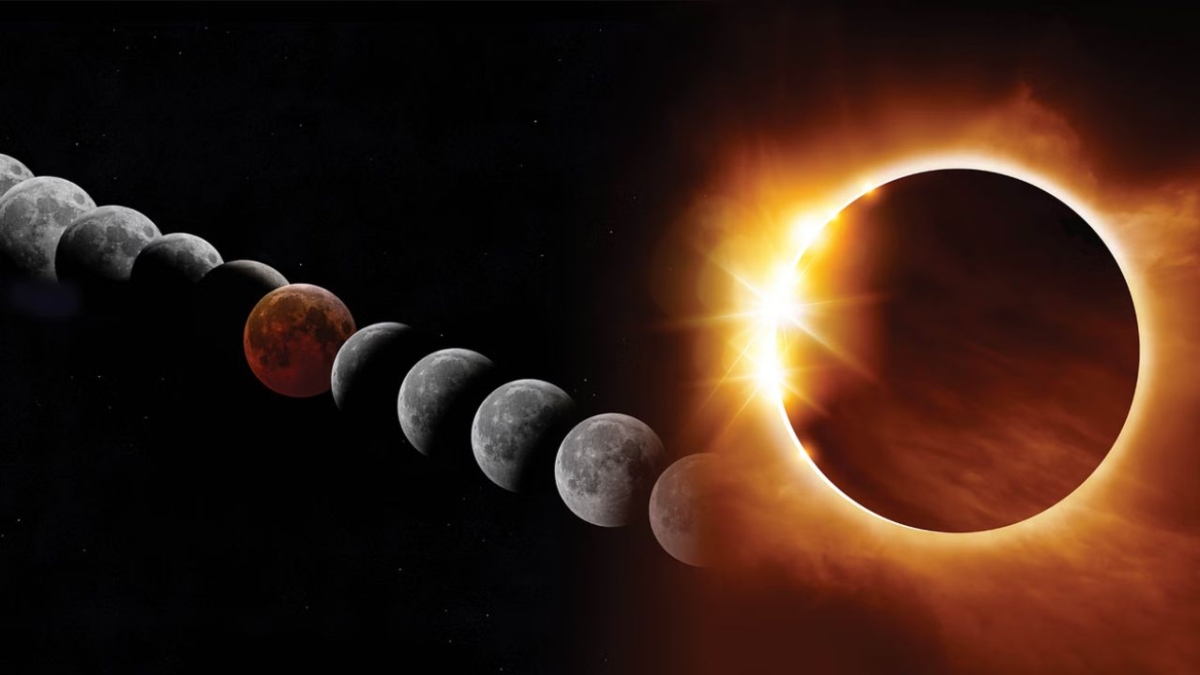

Lunar Eclipse Today: Chandra Grahan Timings, Sutak Kaal, Do's & Don'ts For Pregnant Women During Blood Moon

Happy Holi 2026: Best 70+ Wishes, Greetings, Messages, Status To Share On March 3

Benjamin Netanyahu Dead? Is Israel's Prime Minister Bibi Alive? Check Iran's Claim & Fake News

Gold Rate in India Slips Around Rs 26,000/24K in Single Day Amid Escalating Iran-Israel, US Tension; Outlook

Gold Rates & Silver Rates Today Live: MCX Gold Ends Near Rs 1.67 Lakh, Silver Erases Gains; 24K, 22K, 18K Gold

Gold Rates In India Today Crash By Rs 31,100, Third Fall This Week; 24K, 22K, 18K Gold Prices On March 4

Gold Rates & Silver Rates Today Live: MCX Gold & Silver Price To Open Volatile After Holi; 24K, 22K, 18K Gold

Gold Rate in India Takes U-Turn! 24K Jumps Rs 23,000 In Day! Silver Stable After Weak US Jobs Data | March 7

Gold Rate Today: Gold Prices Crash Over Rs 1 Lakh per 24K/100g in 4 Days Amid Iran-Israel Conflict; Outlook

Fall in Gold Rate in India Continues; 24K/100gm Plunges Rs 85,800 in Just 3 Days; MCX Gold Price Flat; Outlook

Click it and Unblock the Notifications

Click it and Unblock the Notifications