FASTag Is Mandatory From Today: Here Are The 5 Things You Need To Know

From today, you will necessarily require a FASTag for your vehicle for passing through toll points while you are travelling. For paying at toll points, the FASTags will be compulsory and allow contactless as well as digital payments at toll points. To eliminate long waits and even cash payments at toll places this initiative was introduced by the government to facilitate digital payments. Multiple banks, namely HDFC Bank, Axis Bank, ICICI Bank, Kotak Bank, Paytm Payments Bank and IDFC First Bank are issuing FASTags at this time. Worth bearing in mind here is that, at more than 720 toll places on national highways across India, the FASTag payments alternative is permitted. To know more about FASTag here the 5 things you need to consider.

A glance at FASTag

The NETC, or National Electronic Toll Collection, operates with digital payment mechanisms established by the National Payments Corporation of India (NPCI) and utilizes RFID innovation to generate payments instantly without stopping the vehicle or paying cash physically. A FASTag is a tag that is mounted from the inside to your rear window. This is Radio-frequency Identification (RFID) allowed by the barcode and is attached to the vehicle's registration specifics. In the barcode itself, the details are located. There will be specific highways that have FASTag readers mounted overhead when you travel through any toll booth on any national highway in India, and when your car crosses under them, the RFID code is identified, processed for your vehicle and the required toll amount is debited from the available prepaid balance. This allows you to pay the toll charges digitally without having to wait for long queues and pay through cash.

Benefits of installing a FASTag

There are lanes at toll plazas dedicated solely for FASTag drivers, according to the National Highway Fee (Determination of Rates and Collection) Rules 2008. Readers mounted overhead recognize the FASTag, the payment is rendered smoothly, and you're on your journey. The method is so smooth, that there's no need to pause at the toll plaza for making payment cash payment. There is a multi-pronged government drive for electronic digital payments at toll places across India. One benefit is that the cash dealing and the authorities operating toll plazas are minimized to allow for greater efficiency in the process. The queue at toll places are often supposed to be shortened, which is sometimes due to cash collections, individuals attempting to locate the specific difference or even disputes over the exact toll amount. With FASTag installed on your car, you can save both your valuable time and fuel as you do not have to wait for making toll payment physically.

How to purchase a FASTag?

Here, you have several choices. You can buy one at some toll places across India if you need to purchase a FASTag for your car, by keeping your identity proof and also the vehicle registration records handy. By going through this KYC procedure you can buy a FASTag for your car instantly. Or, and this might also be easier if you purchase one on Amazon.in or contact some banks for the same. Financial institutions such as HDFC Bank, ICICI Bank, State Bank of India, Kotak Bank, Axis Bank as well as Paytm Payments Bank are among the banks currently offering FASTags.

Charges required to purchase a FASTag

Two factors rely on the price of acquiring a FASTag. Firstly, the type of vehicle for which you purchase and the bank from which you purchase the FASTag will have its own rules on approval fees and service charges. For example, you can purchase a FASTag for a car from Paytm for Rs 500 as of now, including a reclaimable security deposit of Rs 250 and the minimum balance limit of Rs 150 that requires to be kept. You can pay a tag issuance fee of Rs 99.12 plus Rs 200 as the deposit balance and Rs 200 as the minimum limit balance if you buy it from ICICI Bank. There are small price variations, but with the addition of a new FASTag, banks also package several discounts or cashback in most instances.

How to recharge a FASTag?

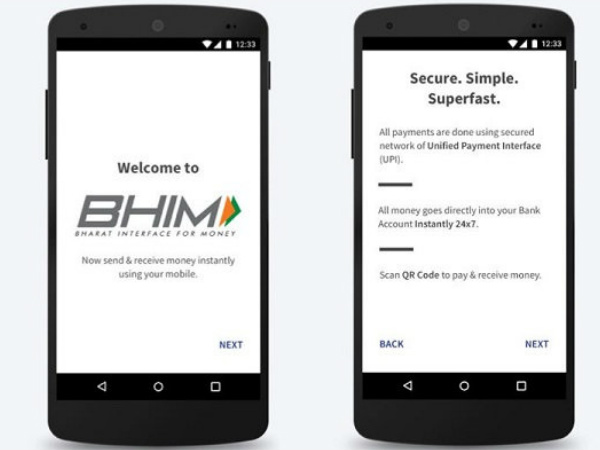

There are two ways for you to recharge a FASTag, i.e. to use the FASTag wallet generated by the authorizing bank and to recharge it via online banking, credit or debit cards or UPI, based on the alternatives provided by the bank. Lastly, you have mobile wallet applications such as Paytm and PhonePe that allow you to refill the FASTag of almost every issuing bank. For a term of 5 years from the date of issuance, the FASTag is valid. The recharge you render for the FASTag account stays active for the full period of the validity of the FASTag in the account.