Eating Out Set To Be Cheaper After GST Revamp: Know More

Launched on July 1, the GST weaved 29 states into a single market with one tax rate.

In the biggest GST rejig yet, tax rates on over 200 items, ranging from chewing gum to chocolates, to beauty products, wigs, and wrist watches, were cut to provide relief to consumers and businesses amid the economic slowdown.

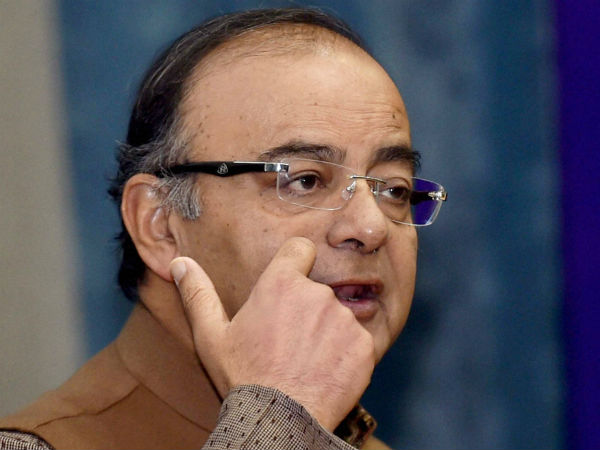

As many as 178 items of daily use were shifted from the top tax bracket of 28 per cent to 18 per cent, while a uniform 5 per cent tax was prescribed for all restaurants, both air-conditioned and non-AC, Finance Minister Arun Jaitley said after the GST Council meeting.

GST on food bills

Currently, 12 per cent GST on food bill is levied in non-AC restaurants and 18 per cent in air-conditioned ones. All these got input tax credit, a facility to set off tax paid on inputs with final tax. Jaitley said the restaurants, however, did not pass on the input tax credit (ITC) to customers and so the ITC facility is being withdrawn, and a uniform 5 per cent tax is levied on all restaurants without the distinction of AC or non-AC. Restaurants in starred-hotels that charge Rs 7,500 or more per day room tariff will be levied 18 per cent GST, but ITC is allowed for them. Those restaurants in hotels charging less than Rs 7,500 room tariff will charge 5 per cent GST but will not get ITC.

New GST rates

The all-powerful GST Council pruned the list of items in the top 28 per cent Goods and Services Tax (GST) slab to just 50 from current 228. So, only luxury and sins goods are now only in the highest tax bracket, and items of daily use are shifted to 18 per cent.

Tax on vehicles

Also, tax on wet grinders and armoured vehicles was cut from 28 per cent to 12 per cent, he said, adding the tax rate on six items was reduced from 18 per cent to 5 per cent, on 8 items from 12 per cent to 5 per cent and on six items from 5 per cent to nil.

Tax on daily use items

Chewing gum, chocolates, coffee, custard powder, marble and granite, dental hygiene products, polishes and creams, sanitary ware, leather clothing, artificial fur, wigs, cookers, stoves, after-shave, deodorant, detergent and washing power, razors and blades, cutlery, storage water heater, batteries, goggles, wrist watches and mattress are among the products on which tax rate has been cut from 28 per cent to 18 per cent.

Top tax for luxury products

The top tax rate is now restricted to luxury and demerit goods like pan masala, aerated water and beverages, cigars and cigarettes, tobacco products, cement, paints, perfumes, ACs, dish washing machine, washing machine, refrigerators, vacuum cleaners, cars and two-wheelers, aircraft and yacht. The cut in tax will cost Rs 20,000 crore in revenues annually, Bihar Deputy Chief Minister Sushil Kumar Modi said.

One India one tax

Launched on July 1, the GST weaved 29 states into a single market with one tax rate, but while traders and small business complained of increased compliance burden, voices of dissent rose on the high tax rate on some common use goods. With the economy growing by its slowest pace since Narendra Modi government came to power, the "panic-stricken govt has no option but to concede demands for change" in the tax, former Finance Minister P Chidambaram, said on Twitter today.

GST return

In ease compliance burden, the Council relaxed the return filing criteria and also lowered the penalties for late filing. "As part of efforts to rationalize GST structure, the Council has been reviewing rates from time to time. In the last 3 meetings, we have been systematically looking at 28 per cent tax bracket and rationalizing certain items out of that bracket into lesser categories, mostly 18 per cent or even less," Jaitley said.

GST tax slabs

GST tax slabs of 5, 12, 18 and 28 per cent were decided going by the principle of fitting each item into a category most close to cumulative pre-GST taxes. "Optically, some items should not have been in 28 per cent despite being in old regime. Secondly, some items manufactured by small entities had excise exemption," he said, adding in the last meetings 30-40 items have been taken out of 28 per cent bracket.

Comments

Bipin Sapra, Tax Partner, EY India, said, "While the reduction of rates would substantially reduce the prices of a number of commodities; however the government may need to balance the revenue considerations too."

Krishan Arora, Partner, Grant Thornton India LLP said the decision of GST Council on pruning of the 28 slab list would be a welcome move for many industries in mass consumption space.

In certain cases, it is also likely to bring down the total tax impact even lower than earlier regime which would be a big relief to the industry as well as consumers.

Rationalisation exercise of tax slabs needs to be carried out comprehensively keeping in mind the significance of the industry and the overall tax incidence under earlier regime, Arora said.

Vishal Raheja of Taxmann described the move as "great step" and said, "In future, we may expect that Government will further slash tax rates by moving from 4-tier tax slabs to lesser slabs or even single GST rate".

Abhishek A Rastogi of Khaitan & Co said while it was expected that there will be rate cuts, it was never expected that the list will be trimmed down so significantly.

"With the rate reduction on a plethora of products, the next step of the government should be to ensure that the benefit of the rate reduction goes to the consumers," he said. "It appears that after this mass rate reduction various anti-profiteering problems may kickoff for businesses which would not pass on the benefit to the consumers.

Source: PTI

Goodreturns.in