RBI Keeps Repo Rate Unchanged For 7th Time In A Row

The Reserve Bank of India's rate-setting panel, the Monetary Policy Committee (MPC), kept key interest rates unchanged and maintained its accommodative policy stance.

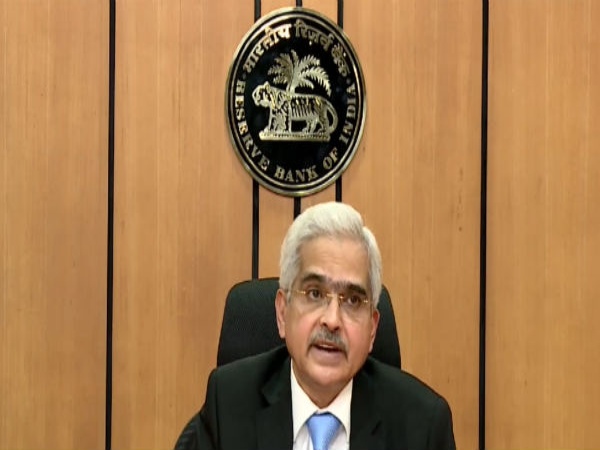

Governor Shaktikanta Das and members of the monetary policy committee (MPC) chose' status quo.' The policy repo rate in India remains at 4%. Governor of the Reserve Bank of India (RBI) Shaktikanta Das stated that the monetary stance remains "accommodative."

The country's reverse repo rate, meanwhile, remained unchanged at 3.35 percent. The marginal standing facility (MSF) rate is 4.25 percent, while the Bank Rate is 4.25 percent.

RBI has projected India's GDP growth at 9.5 percent for the ongoing FY22. The RBI MPC expects CPI-based inflation to be 5.7 percent in FY22. The retail inflation target for FY22 has been revised to 5.7 percent from 5.1 percent previously.

The repo rate is the rate at which commercial banks borrow money by selling their assets to our country's central bank, the Reserve Bank of India (RBI), in order to sustain liquidity in the event of a cash shortage or owing to statutory measures. It is one of the RBI's primary strategies for managing inflation.

The six-member rate-setting panel unanimously voted to maintain the status quo. The MPC has decided to maintain an accommodating position for as long as it is necessary to mitigate the effects of Covid 19.

Key policy rates, such as the repo and reverse repo rates, are kept at historic lows. As long as the RBI is focused on economic recovery, the accommodative monetary policy stance will be maintained.

Inflation

In May, CPI inflation surprised to the upside, but price movement slowed. The overall demand outlook is better, but underlying fundamentals remain weak. In a number of sectors, more has to be done to restore supply-demand balance, Governer said.

Given the current state of the domestic economy, there is a compelling rationale for sustained governmental support. There are no fresh liquidity measures on the horizon. Existing measures can be lengthened and expanded in terms of segment coverage.

Mr. Sandeep Bagla, CEO of TRUST Mutual Fund, shares his thoughts on the RBI's monetary policy below.

"RBI policy is hawkish at the margin. RBI has acknowledged the strong growth and negative surprise on inflation front. One of the MPC members has voted for change in accommodative stance. While there is no real change in the policy, bond market participants will take the nuanced change in language seriously. There is a distinct possibility that yields at the longer end, 10 years, will inch up towards 6.50% gradually. Investors should invest in bond funds with lesser than 3 years maturity to minimise interest rate risk."

| RBI MPC | Rate |

|---|---|

| 6 August 2021 | 4.00% |

| 4 June 2021 | 4.00% |

| 4 December 2020 | 4.00% |

| 9 October 2020 | 4.00% |

| 06 August 2020 | 4.00% |

| 22 May 2020 | 4.00% |

| 27 March 2020 | 4.40% |

| 6 February 2020 | 5.15% |

| 5 December 2019 | 5.15% |

| 4 October 2019 | 5.15% |

| 7 Augst 2019 | 5.40% |

| 6 June 2019 | 5.75% |

| 4 April 2019 | 6.00% |

| 7 February 2019 | 6.25% |