Why Are Silver Prices Falling Lately?

In 2019, when gold rallied amid US-China trade tensions, silver's gains were higher as it was favoured by traders for being the more lucrative safe haven asset among precious metals and also for an increase in its demand for industrial use. Silver futures on MCX had crossed Rs 51,000/kg mark in the second half of 2019.

However, in 2020, with a more uncertain economic crisis at hand due to the coronavirus pandemic, its only gold that climbed to a new high of over Rs 45,000 per grams, earlier this month and silver has been trading significantly lower.

On Tuesday, silver futures closed over 2 percent or 754 lower at Rs 35,453 per kg after having fallen to an intraday low of Rs 34,300 during the day.

What is dragging silver prices lower?

The coronavirus spread has put major manufacturing hubs around the world in a lockdown, especially in China-the world's factory, where the virus originated.

China's factory activity saw its biggest ever decline in February. According to official numbers released by the Chinese government, industrial output declined 13.5 percent in the country in the January-February period from a year ago, compared with December's 6.9 percent increase.

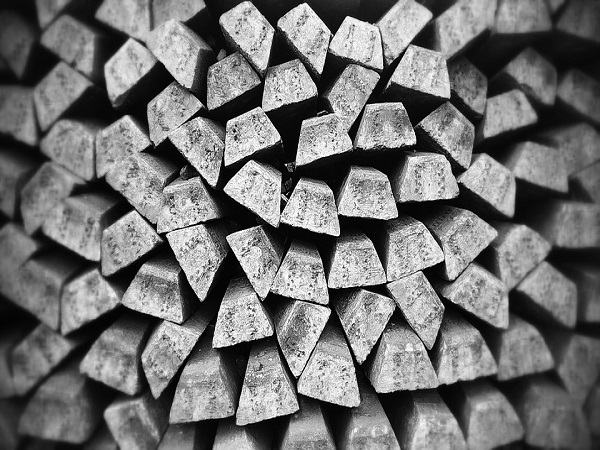

A major concern for investors of silver is that 60 percent of the metal's total demand comes from industrial fabrication. It is used to solder and braze alloys, batteries, dentistry, glass coatings, LED chips, medicine, nuclear reactors, photography, photovoltaic (or solar) energy, RFID chips, semiconductors, touch screens, water purification, wood preservatives, etc. It is a good thermal and electrical conductor, making it ideal for electrical applications.

The metal is of value to the largest manufacturing product makers (in terms of revenue) in the world- Samsung, Apple, Toyota and Volkswagen, the makers of cars and gadgets. These companies have either taken their work offline or are affected by the disruption in their supply chain due to government-imposed shutdowns in China.

Last year, an increase in demand for climatic change conscious products like electric vehicles and solar panels had raised the value of silver and palladium. Palladium is used in catalytic converters of cars that remove hydrocarbons, carbon monoxide, and other harmful gases from exhaust emission. Silver is needed in the manufacturing of self-drive vehicles and production of solar power.

In the current economic and social environment, it is most unlikely that consumers would think about making big-budget purchases like a car or a gadget. This will potentially impact the demand and quarterly profits of these companies.

Another major impact of the pandemic is the selling spree seen across markets. To recover from the drastic losses in the equity and oil markets, traders are selling gold and silver.

The future

Concerns of an economic slowdown due to the pandemic has caused investors to prefer holding on to cash rather than assets until there are clear signs of recovery.

Coronavirus infections cases are rising by the day, even in China, where new cases, although small in number, are still being reported every day.

The working class are worried that they could lose their jobs if the global economy entered a recession.

However, on Wednesday, Silver futures opened higher after major central banks like the US Fed and the Bank of England announced liquidity boosting measures to support its residents facing cash crunch. It was trading over 1.34 percent at Rs 35,928 per kg.

These announcements have caused international prices to recover, which also impacts domestic price of the metal.

In China, consumers have started gingerly venturing into malls and restaurants, encouraged by the sharp drop in new virus infection cases in the country. Some manufacturing units in the country have reopened, but things are far from attaining regular normal production levels.

Only the coming weeks will tell if the coronavirus crisis has been contained across the globe and when factories will operate in full swing.