The Insurance Regulatory and Development Authority of India (IRDAI) in a press release dated 4 January announced the introduction of a standard home insurance policy that will cover the risk of fire and allied perils for certain risks.

The insurance regulator said that in order to complete the process of de-tariffing for the risks of Dwellings and micro level and small level enterprises, it has issued guidelines whereby the Standard Fire and Special Perils (SFSP) Policy provided for in the erstwhile AIFT 2001 will be replaced by the following standard products:

- Bharat Griha Raksha (meant for Home Building and Home Contents)

- Bharat Sookshma Udyam Suraksha (meant for enterprises where the total value at risk is up to Rs 5 Crore)

- Bharat Laghu Udyam Suraksha (meant for enterprises where the total value at risk is more than Rs 5 Crore and up to Rs 50 crore)

IRDAI has directed all general insurers carrying on fire and allied perils insurance business to offer the above products with effect from 1 April 2021.

Features of Bharat Griha Raksha

1. Perils covered:

The standard home insurance policy will come with a wide range of perils, namely Fire, Natural Catastrophes (Storm, Cyclone, Typhoon, Tempest, Hurricane, Tornado, Tsunami, Flood, Inundation, Earthquake, Subsidence, Landslide, Rockslide), Forest, Jungle and Bush fires, Impact Damage of any kind, Riot, Strike, Malicious Damages, Acts of terrorism, Bursting and overflowing of water tanks, apparatus and pipes, Leakage from automatic sprinkler installations and Theft.

2. Time:

The policy will provide cover within 7 days from the occurrence of any of the above-said events.

3. Wider coverage:

Besides home building, the policy covers General Home Contents automatically (without any need for a declaration of details) for 20% of the sum insured for the Building subject to a maximum of Rs 10 lakh. One can also opt for a higher sum Insured for general contents by declaring the details.

4. Optional covers:

Bharat Griha Raksha policy comes with two optional covers:

- Insurance for Valuable Contents like jewellery and curios.

- Personal Accident of the insured and spouse due to an insured peril under the policy.

5. Other features:

- The policy does not provide complete waiver of under-insurance. In other words, if the sum insured declared by a policyholder is less than what ought to have been declared for the property in question, the policyholder's claim will not be settled proportionately but up to the sum insured that is declared. For example, if the general home contents (such as fridge, television, washing machine) are insured for a sum of Rs 50,000, while the actual value is Rs 1 lakh, the policy will still pay the entire sum insured (Rs 50,000).

- Like all standard insurance policies introduced by IRDAI, the product has been designed with policyholder friendly features and are worded in simple language for the convenience of the general public.

- The policy will have Key Features Documents (KFD) which give basic information about the products, apart from answers to Frequently Asked Questions (FAQ).

- Insurers have been permitted to file innovative add-ons (additional covers) over and above the basic cover, in-built cover, optional cover, if any, and standard add-ons that these retail products already offer.

More From GoodReturns

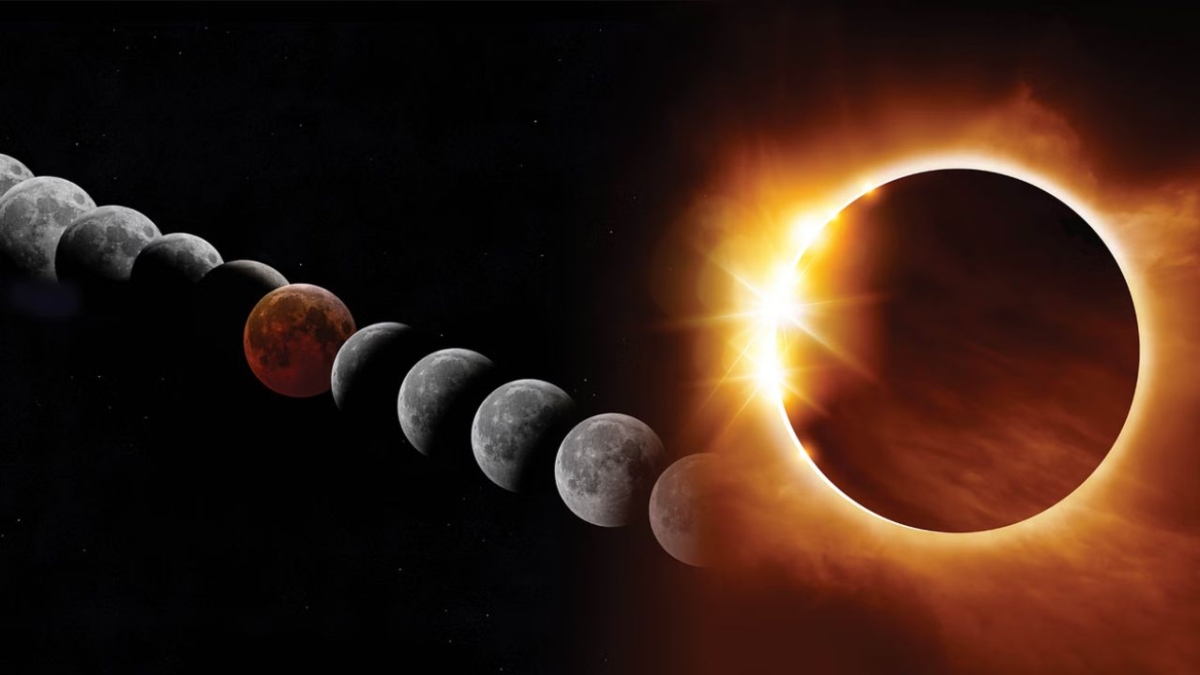

Lunar Eclipse Today: Chandra Grahan Timings, Sutak Kaal; Blood Moon Visibility in India on March 3, 2026

Gold Rates & Silver Rates Today Live: Spot Gold Price Jumps 2% As Crude Oil Prices Fall; 24K, 22K, 18K Gold

Lunar Eclipse Today: Chandra Grahan Timings, Sutak Kaal, Do's & Don'ts For Pregnant Women During Blood Moon

Happy Holi 2026: Best 70+ Wishes, Greetings, Messages, Status To Share On March 3

Benjamin Netanyahu Dead? Is Israel's Prime Minister Bibi Alive? Check Iran's Claim & Fake News

Gold Rate in India Slips Around Rs 26,000/24K in Single Day Amid Escalating Iran-Israel, US Tension; Outlook

Gold Rates & Silver Rates Today Live: MCX Gold Ends Near Rs 1.67 Lakh, Silver Erases Gains; 24K, 22K, 18K Gold

Gold Rate Jumps Rs 81,300 per 24K/100gm in a Month; Check Weekly Gold Price Forecast Amid Iran-US Tension

Gold Rates In India Today Crash By Rs 31,100, Third Fall This Week; 24K, 22K, 18K Gold Prices On March 4

Gold Rates & Silver Rates Today Live: MCX Gold & Silver Price To Open Volatile After Holi; 24K, 22K, 18K Gold

Gold Rate Today: Gold Prices Crash Over Rs 1 Lakh per 24K/100g in 4 Days Amid Iran-Israel Conflict; Outlook

Click it and Unblock the Notifications

Click it and Unblock the Notifications