How To Buy Silver In India? Different Investing Options In Silver

Silver has long been seen as a viable alternative to standard assets such as stocks and bonds. Some investors resort to silver to hedge their risks or invest more defensively when circumstances go rough or it appears that the Federal Reserve is actively printing money. Investing in silver entails putting money into its production, trading, or ownership. Silver bullions in the shape of coins and bars are possessed in India.

Silver's price, like that of most precious metals, is determined by market forces. The MCX price and value of silver are primarily determined by its demand as an investment. Individuals can buy silver coins, biscuits, bars, and other items, the prices of which fluctuate daily based on the MCX rates; there may be a premium or a reduction relative to the MCX pricing.

Due to the lack of exchange-traded funds (ETFs), the only ways to invest in silver are through physical purchases from jewellers or commodities futures.

The disadvantage of relying on commodity futures is the unusually high cost of carrying compared to gold.

Silver Coins

If you want to buy precious metals for investment rather than to wear, silver coins are ideal because you won't lose money on transaction fees or have to buy in larger quantities. You can start with as little as one gram and use the accumulated amount to make jewellery in the future if necessary.

Coins, on the other hand, are slightly more expensive than silver bars since they usually have some type of art or picture, as well as labor costs, which are added to the final price.

On the other hand, it has advantages in that it allows you to purchase silver for a very low price. It's a terrific alternative for employees and business owners who want to save money on a regular basis.

You can accumulate a certain number of coins each month based on your financial capacity, and you can sell them at a later point if you need to liquidate your assets.

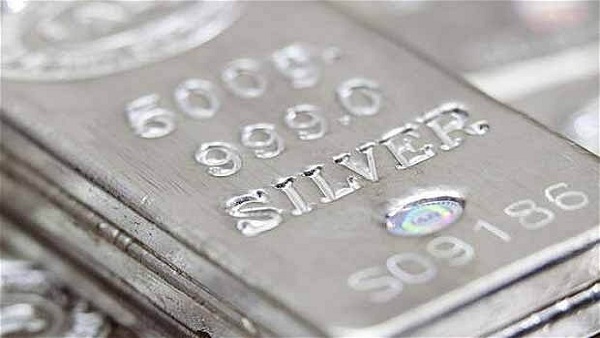

Silver Bars

You can put a large sum of money into such silver bars and effortlessly save for the future. Silver bars are in high demand on the market, so you won't have any trouble selling them later.

You can choose silver bars instead of coins by looking for the greatest bargains in the market from reputable vendors.

Banks are unlikely to sell them since they are big, and banks prefer to sell only packaged coins that have been certified by reputable sources.

Different Investing Options In Silver

Commodity Market- Silver Futures

You can still invest in silver through the commodity market if you aren't interested in buying physical silver. The investment required will be slightly greater than normal silver, and you will be required to pay a percentage of the contract's total value.

Silver futures are a simple way to bet on the price of silver growing or falling without the difficulties of owning physical silver. You could even take physical delivery of the silver, though this isn't the most common motive for futures traders.

Make sure you have enough money to cover any additional costs that may arise as a result of fluctuations in the price of silver on the international market. You can easily sell the futures at a later date before they expire if you make a good profit.

E-Silver, which may be purchased on the National Spot Exchange or Multi Commodity Exchange in the same way as shares and stored in a de-materialized form, is the finest option to invest in silver.

How to Buy Silver in India?

Silver coins and bars can be purchased both online and offline. Silver coins are sold by almost all banks. If you are interested in buying silver in paper form, you can check the MCX website for more details.

Online/Shops

Silver coins from branded jewellers are available from a variety of online popular shops. These offer a variety of imprints (artwork) and dimensions to pick from, as well as savings on orders. The things sold on these websites, on the other hand, are frequently very expensive. The rates will be higher if you buy coins with specific designs on them.

Different Investing Options In Silver

Banks

Customers can acquire silver coins directly from the most reputable banks. They sell certified silver coins and bars, which can be purchased in various weights. If you buy in bulk, you may be charged a processing fee. Prices will be based on current exchange rates, and you may be required to pay a modest premium for the certificate and/or artwork.

MCX

You must use the services of a broker who is a member of the commodity exchange to invest in silver futures. You must pay an initial margin to the broker prior to trading. That is, you must pay a percentage of each transaction you make on the exchange. In general, these futures have minimal margins.

Conclusion

Always keep in mind that the price of silver in India is influenced by worldwide financial markets. Other worldwide markets may experience a surge or decline, depending on the market. And this has a direct impact on silver's pricing. You must be aware of market fluctuations and manage your investments accordingly.