Post Office providing a host of services, including banking, insurance and mail services under one roof, serves the society by providing a platform for saving and investment. With an array of saving schemes, Indian citizens can park their capital in fairly safe saving schemes of Post Office depending on the disposable income and investment horizon. Here is a list of post office saving schemes for your reference:

Earning as high as 8.3% p.a

With no cap on the maximum amount, post office RD offers an interest rate of 8.3% p.a i.e. compounded quarterly. The nomination facility is available for the scheme, also partial withdrawal is allowed after one year of opening the account. The scheme can again be renewed for a further 5-year period.

Invesment option qualifies for benefit unde Sec 80C

For 1, 2, 3 and 5years term deposit, the institution offers interest rate of 8.2%.,8.2%, 8.3% and 8.4% respectively. The term deposits can be pre-closed after a term of 1 year at discount. 5-year term deposit qualifies for deductions u/s 80C of the Income Tax Act.

Regular saving investment option offers 8.4%

In multiples of Rs. 1500, an individual either in a single name or jointly can open an MIS account. The rate of return on the scheme is 8.4% i.e. payable monthly. The bonus paid on MIS schemes previously is no longer offered on deposits made after 1st December'2011.

Good investment avenue for senjsior citizens with high return

Individuals aged 60 years and above can open the account. Also, individuals in the age bracket of 55-60 years can also open the account in case of retirement through VRS or super-annuation. Investment in multiples of Rs. 1000 and not in excess of Rs 15 lacs can be deployed in the scheme. Schemes offers an interest of 9.2% that is credited on a quarterly basis. Maturity term for the scheme is 5 years with an option of premature closure.

Must opt for investors with no liquidity concerns

With a minimum amount of Rs. 500 and a maximum of Rs. 1 lac in a financial year, investor can earn an interest rate of 8.7% annually. Joint PPF accounts can not be opened and even if the subscriber opens the cap in the name of the minor child, cap with regard to maximum investment has to be adhered to. Interest earned is totally tax-free. The only drawback of PPF is premature closure of the account is not allowed. Loan is also available from 3rd year onwards.

With tax benefits NSC offers interest close to 9%

The 5-year NSC offers an interest rate of 8.5% that is compounded half-yearly but is paid at maturity. Other NSC with 10 year maturity offers 8.8% interest rate. Investment into NSC qualifies for tax benefits under Sec 80 C. Further, interest earned and accrued on an annual basis is deemed to be re-invested under the same section.

More From GoodReturns

Gold Rates & Silver Rates Today Live: Gold Rates Jump Amid US-Israel-Iran War, Silver Price Flat On March 1

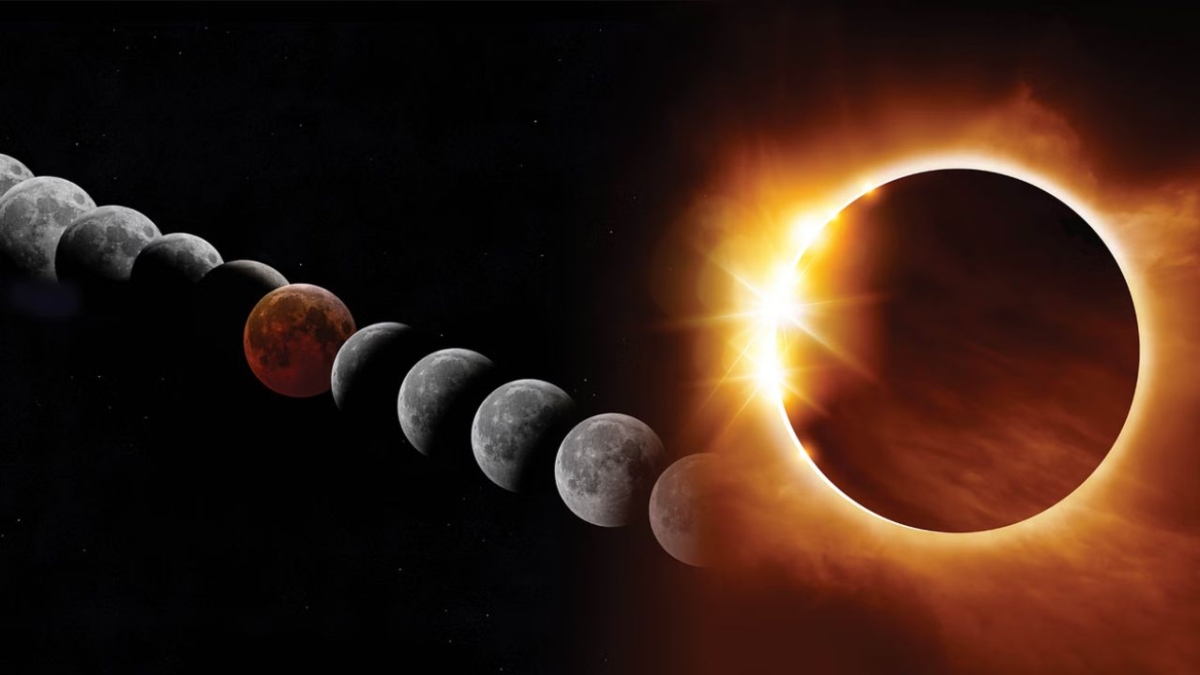

Lunar Eclipse Today: Chandra Grahan Timings, Sutak Kaal; Blood Moon Visibility in India on March 3, 2026

Lunar Eclipse Today: Chandra Grahan Timings, Sutak Kaal, Do's & Don'ts For Pregnant Women During Blood Moon

Happy Holi 2026: Best 70+ Wishes, Greetings, Messages, Status To Share On March 3

Benjamin Netanyahu Dead? Is Israel's Prime Minister Bibi Alive? Check Iran's Claim & Fake News

Gold Rates & Silver Rates Today Live: MCX Gold Ends Near Rs 1.67 Lakh, Silver Erases Gains; 24K, 22K, 18K Gold

Gold Rates & Silver Rates Today Live: Spot Gold Price Jumps 2% As Crude Oil Prices Fall; 24K, 22K, 18K Gold

Gold Rate in India Slips Around Rs 26,000/24K in Single Day Amid Escalating Iran-Israel, US Tension; Outlook

Gold Rate Jumps Rs 81,300 per 24K/100gm in a Month; Check Weekly Gold Price Forecast Amid Iran-US Tension

Gold Rates & Silver Rates Today Live: MCX Gold & Silver Price To Open Volatile After Holi; 24K, 22K, 18K Gold

Bonus Issues, Stock Splits, Rights Issues, Dividends From 2- 6 March; Full List of Corporate Actions Next Week

Click it and Unblock the Notifications

Click it and Unblock the Notifications