Pros of using Credit Card in India

A credit card is a card issued by a financial company giving the holder an option to borrow funds, usually at the point of sale. Credit cards charge interest and are primarily used for short-term fina

A credit card is a card issued by a financial company giving the holder an option to borrow funds, usually at the point of sale. Credit cards charge interest and are primarily used for short-term financing. Interest usually begins one month after a purchase is made, and borrowing limits are pre-set according to the individual's credit rating.

What is Credit Card?

A Credit Card is a payment card issued to the users to enable the cardholder to pay a merchant for goods and services based on the cardholder's promise to the card issuer to pay them for the amounts so paid plus the other agreed charges.

Credit Cards combine payment services with extensions of credit. Credit cards allow the consumers to have a continuing balance of the debt, subject to interest being charged.

Advantages of using Credit Card

Rewards/ Points

Rewards will be in the form of a point system which a user of credit card will earn per rupee spent on every purchase transaction. Often banks will offer special promotional offers for the customers to use there credit cards, which will entitle them to accumulate points on the purchase of specific category of items.

After accumulating specific points, one can redeem the points for gift vouchers or gift cards at some stores or buy items from the credit card company's reward category.

Cash Back

The cash back credit card was popularized in the United States. Credit cardholder will be entitled to get cash back on selected transactions. Say for example some restaurants offer cash back on selected bank's credit card transaction, and the user of the card will get 10% of the bill amount refunded regardless of the price of the bill.

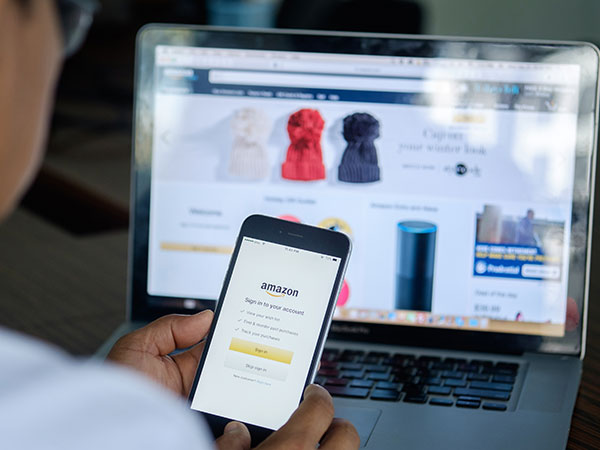

Most of the retail business houses, petrol bunks, cinema halls, online shopping firms provide cash back offers to promote the products/services to the target customers. In such case, the account holder will be the beneficiary of the transaction. For example, Amazon is providing additional cash back discount offer up to 10% on site and on an app for all the customers who are using HDFC Credit Card during the ongoing Amazon Great Indian Sale 2018.

Protection

The credit cardholder gets more protection than the debit cardholder. The cardholder will have protection if the card is used fraudulently as the card provider should refund the money. For example, in case if a person loses his/her credit card and a transaction has been made using the credit card without the knowledge of the holder of the card, then the individual can reclaim full amount back from the credit card provider.

Borrow for Free

Some credit card providers offer 0% periods, means an individual can benefit from the interest-free loan. One has to make a minimum monthly payment and clear the balance before the 0% offer ends otherwise one will be charged 18% of interest.

Credit card statements quote that one will get up to 59 days interest-free, post 59 days interest will be charged. Its a better option to pay the credit card bill before the deadline as this will also help in managing cash flow efficiently.

Earn while you spend

Some credit card companies provide more benefits to its customers in the form of cashback, reward points, loyalty points and so on. Users can make money from the credit card; if bills are paid within the stipulated time or else, they will be charged interest exorbitantly.

Invest Wisely

An individual can invest the money earned from salary into various investment schemes and can use a credit card to pay monthly bills, grocery, household and other expenses. In this way, he/she will be investing on a regular basis, and any payments can be met using the credit card.