How to Store Your PAN Using DigiLocker?

The PAN Card integration with DigiLocker was rolled out by the government this week and it allows you to access real-time PAN verification record from Income Tax (IT) Department. Learn how to store yo

You can now store your PAN (Permanent Account Number) on a cloud-based platform provided by the Government of India known as DigiLocker.

The PAN Card integration was rolled out by the government this week which allows you to access real-time PAN verification record from Income Tax (IT) Department. The Central Board of Direct Taxes (CBDT) has partnered with DigiLocker for the facility.

Learn how to store your PAN using DigiLocker from the step-by-step guide below.

Step 1

Sign up with DigiLocker using your Aadhar, if you haven't done it already. Read: How to Store Your Aadhar With Digilocker? for a step-by-step guide.

Step 2

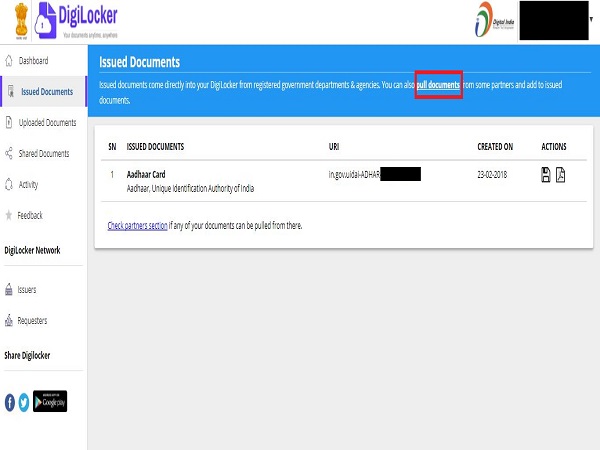

Login into DigiLocker and go to "issued documents" on the left-hand side.

You should be able to see a link for "pull documents" (highlighted in the image above.) Click on it.

Step 3

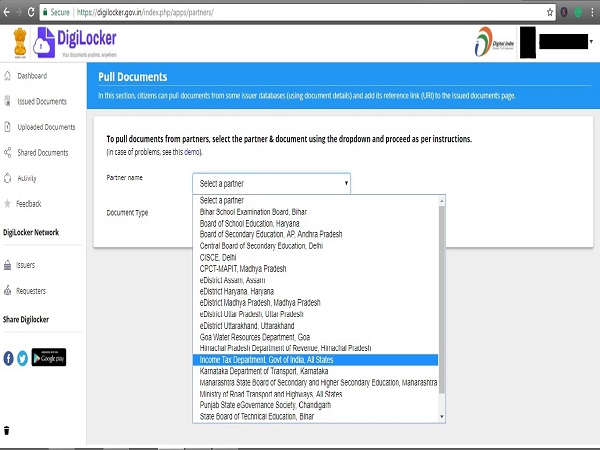

Select "Income Tax Department" from the drop down for partner name and "PAN Card" from document type.

Step 4

Your name and date of birth will be pre-filled from your Aadhar details. Make sure they match with your PAN details.

Enter your PAN Number and select gender from the drop down option. Then, check the consent box and click on "Get Document."

Congratulations, your PAN data will now be fetched by DigiLocker and can the link be accessed under "issued documents."