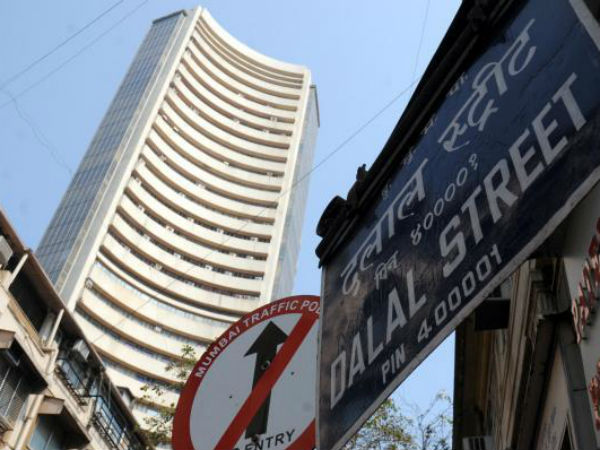

Time To Be A Little Cautious On The Markets

With the Sensex just a few per centage points away from a record high, it is time to be a little cautious on the markets. The Sensex in November had crossed the 41,000 points level mark and is now less than 2 per cent away from that record. The Sensex is trading at near 20 times one year forward earnings, which is rather expensive.

Adopt a bottoms-up approach to investing

A bottoms-up approach to investing would be the right strategy in these markets. Investors would need to pick stocks that are at near 52-week lows or thereabouts. There are many such stocks that are available at attractive valuations. Take the example of Coal India. The stock is trading way below its long-term averages and offers you a dividend yield of near 7 per cent. This is much better than the interest rate offered by SBI on its fixed deposit.

Similarly, a stock like Hindustan Zinc too has good prospects. This company can offer a dividend yield as high as 8 per cent. The stock is not very far from its 52-week low price of Rs 193.

Among the other stocks that could be good picks are the badly battered media stocks. Some of them like TV Today and Jagran Prakashan have been rewarding shareholders through healthy dividends and buyback of shares.

Mutual Fund investment slowing down

Another worrisome feature of the market is that mutual fund investment has been slowing down considerably in the last few months. In fact, the net inflows into mutual funds was a mere Rs 1,300 crores. If mutual fund inflows continue to slow, we may see the markets coming-off a fair bit. In any case the year to date returns from the markets have been fantastic and to expect stupendous returns from here on, would be a little far-fetched. Should FPIs resort to selling, domestic institutional buying could well be limited,

At the moment the risk to reward ratio for the markets does not look too favourable. If you are sitting on losses, you would be forced to hold onto to losses. On the other hand, if you have made profits it would be a good idea to at least partially book profits.

Global cues at the moment are very strong, which is what is leading to the rally. Going ahead, the momentum is unlikely to sustain given that the S&P 500 is at a near record high. It is therefore advised to partially book profits at the current levels.