How to File Income Tax Return Online for Salaried Employee? Step-By-Step Guide

The deadline to file your Income Tax returns for the financial year 2018-19 (AY 2019-20) is 31 August 2019. If your income for 2018-19 exceed the tax-exempt limit, you are required to need to file your income tax returns.

Usually one goes to a professional to file the returns, but if you do not have many investments, you can file your Income Tax Returns by following easy steps online in the comfort of your home, for free. This online filing is also known as e-filing.

Who is required to file income tax returns?

- If your income for the financial year 2018-19 has been more Rs 2.5 lakhs in India excluding the deductions from Section 80C and 80U, you have to file income tax returns (ITR). Even if you are an NRI, your income in India needs to be filed for ITR.

- If you are over 60 years old but less than 80 years, you are you required to file ITR if your income for 2018-19 is over Rs 3 lakh before deductions. If you are over 80 years of age, then you have to file ITR if your income is over Rs 5 lakh before deductions.

- If you want an income tax refund or want to carry forward your losses under any head of income (like loss from sale of equity shares).

- If you have had any long term capital gains during the financial year, you need to file tax even if your income is tax-free.

- If you are planning to apply for a loan or visa, you may be asked for proof of income tax filing.

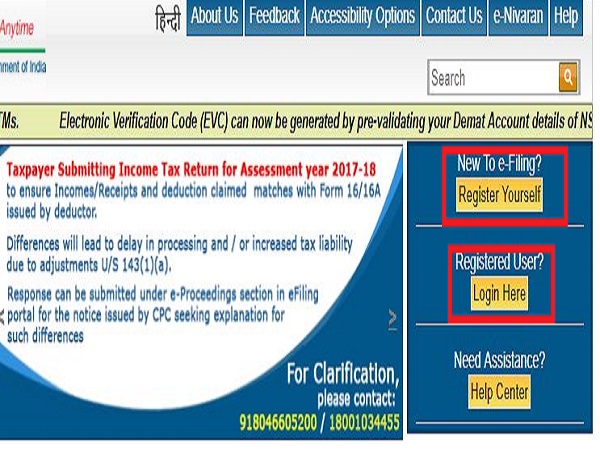

Register or Login

Visit www.incometaxindiaefiling.gov.in.

If have just started earning and this is your first time filing ITR, then click on "Register Yourself." If you have filed your returns before, click on "Login Here."

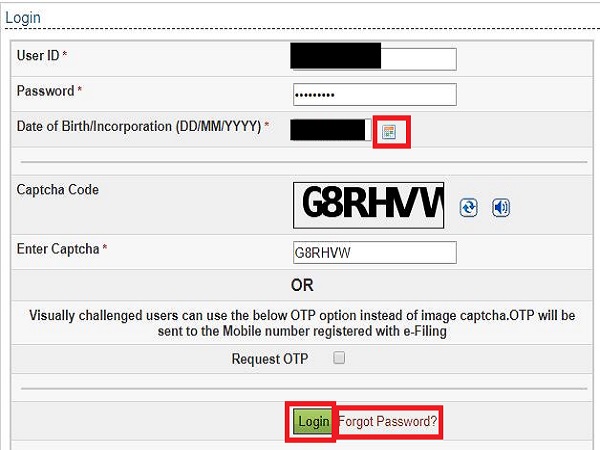

Login details

Your User ID will be your PAN. Enter your date of birth as per your PAN using the input icon next to the box provided.

You can use the "forgot password" option if you wish to change the password.

Which form should you choose to file ITR and how to file it?

It department has various forms depending on the taxpayers requirements. Since this article is focused on salaried individuals only, your form will be ITR 1.

Now, there are two ways to file this form:

1. by downloadng it

2. filing it online.

You can choose to file your returns by downloading the pre-filled excel sheet rather than filing it online if you live in an area with frequent power cuts and internet connection disruptions.

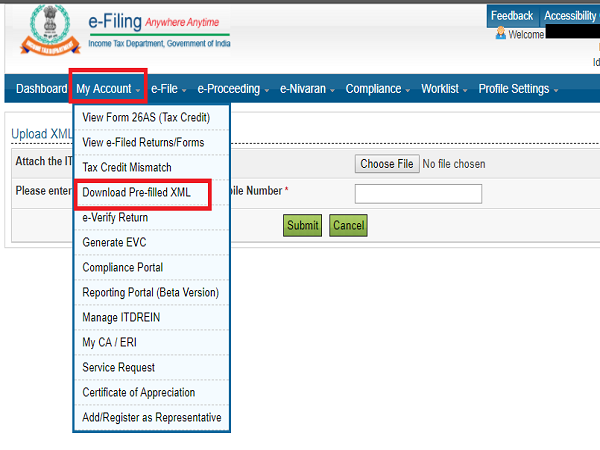

How to download the XML file?

On the page, go to the "My Account" and click on "Download Pre-filled XML." The next page will ask you for your PAN (usually pre-entered), the assessment year and ITR form. Note that your assessment year will be the year next to your financial year. So if you are filing for 2018-19, your assessment year will be 2019-20.

Fill the XML file and pay your taxes

File this XML form with the details from your Form 16.

Once your form is complete. Click on the "calculate tax" in the file. You can pay the tax applicable online and the fill the challan details after you upload the file via Netbanking.

Complete the tax filing

Complete the filing by clicking "Validate." Now generate and save the excel file on your desktop.

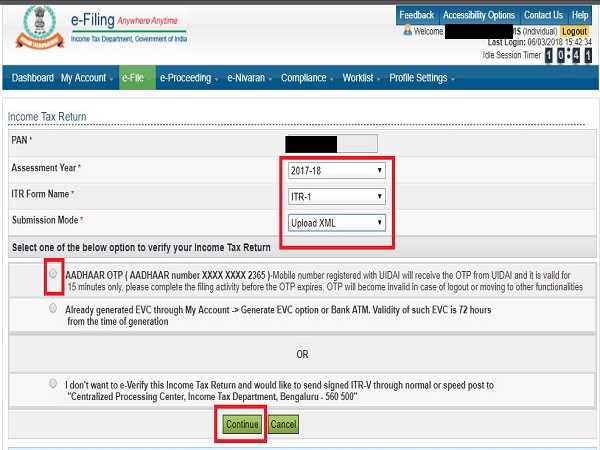

Next, log into the IT department website again and choose upload XML file as your submission mode.

Verification of income tax returns filing

If your Aadhaar is linked already, you can digitally verify the returns using Aadhar OTP. It is the easiest method. You will receive the OTP on your Aadhar linked mobile number and you need to enter this in the space provided.

You will get an acknowledgment form of verification (ITR-V) which you can download for your reference.

If you choose to verify offline, you can download the form and send it to:

Centralized Processing Center,

Income Tax Department,

Post Bag No. 1, Electronic City Post Office, Bangalore, 560 100, Karnataka.

The letter needs to reach the IT department within 120 days of filing the return online.

Important Points to remember before you file your income tax returns

- Your tax deducted at source in form 26AS should match the amount in Form 16. Form 16 will be provided to you by your employer. Also Read: Learn how to check your form 26AS.

- It is important that the two match, because you will receive an income tax notice if they do not match. So you need to rectify if there are any errors.

- Claim your deductions under section 80. Keep your premium receipts at your side to fill the form.

- Keep your last year's returns, your Form 16, your payslips and rent receipts for reference before you start filing, to help you file your tax returns faster.